When President Trump signed the “big beautiful” spending bill into law on July 4th, 2025, it included a provision officially scuttling the nation’s methane waste emissions fee for the next 10 years.

This overwhelmingly popular policy was designed to affect only the worst performers in the oil and gas industry, encouraging them to instead avoid the charge by improving their air emissions performance to industry best practices. But while oil and gas trade groups in Washington worked feverishly to gut the measure, the elimination of the fee overwhelmingly benefits just a handful of companies.

Key findings

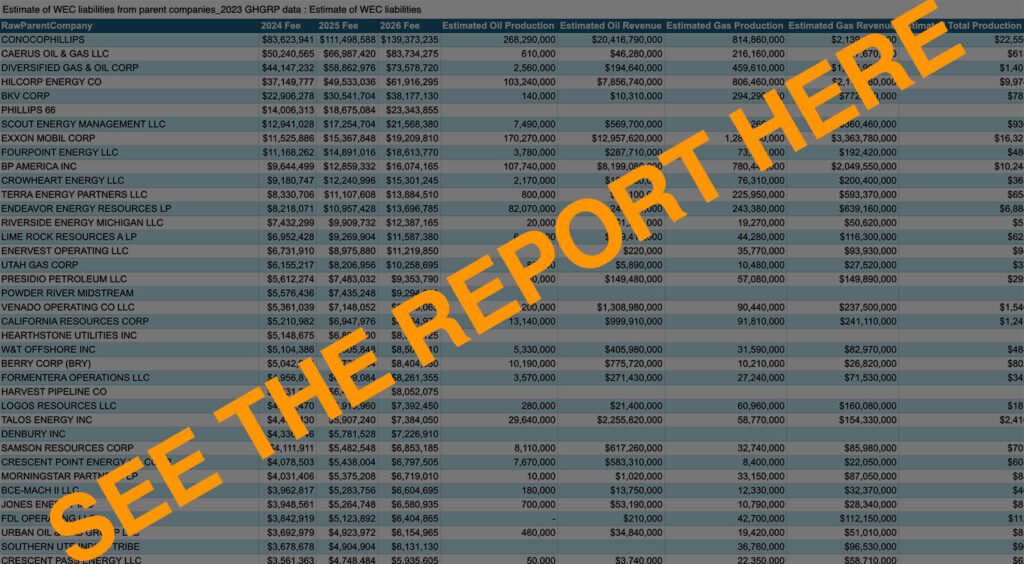

New analysis from Gas Leaks estimates the decade-long delay of the methane Waste Emissions Charge will cost the U.S. government nearly $1 billion in lost revenue in 2026 alone. However, more than half of that lost revenue benefits just 10 oil and gas companies, and by far the top beneficiaries are ConocoPhillips, Caerus Oil & Gas, Diversified Energy, Hilcorp Energy, and BKV Corporation.

Even worse, this pollution bailout is being handed to some of America’s most profitable corporations. Our analysis finds that more than 80% of the projected fees would have been paid by companies with over $100 million in production revenues in 2023, and nationally, the projected fees would have made up just 0.2% of total production revenues of reporting companies.

Estimating based on the most recent reported emissions data [more on our methodology below], our analysis projects that methane pollution fees would have totaled $582 million for 2024, $776 million for 2025, and $971 million for 2026. And instead, we estimate this delay effectively greenlights over 640,000 metric tons of excess methane emissions annually, with the equivalent climate impact of operating 14 coal power plants a year, or driving 13 million passenger cars.

Key fEstimated methane Waste Emissions Charge liabilitiesindings

Methodology

Gas Leaks analyzed 2023 Greenhouse Gas Reporting Program data reported by the U.S. Environmental Protection Agency. We netted emissions at the parent company level, then assessed emissions exceeding statutory thresholds for each parent company and their subsequent projected fees. Oil and gas revenues were calculated using the average 2023 Henry Hub gas price, the average 2023 West Texas Intermediate crude oil price, and 2023 production data.